Your Actively Managed Fund May Be Costing You More Than You Think

You think your mutual fund investment is a good deal because it only has an Expense Ratio of say 0.9%? Maybe or maybe not. You might actually be paying a good deal more than that and you don't know it...

All mutual funds have to tell you how much participating in their fund will cost you and you'll generally find that information in a "Fees & Expenses" section of a prospectus or the fund profile on Yahoo! Finance. In addition to the Expense Ratio, there are also potential sales loads, 12b-1 fees, etc., but the focus of this article is an implied cost and can only be hinted at in something known as the "Turnover Ratio".

The Turnover Ratio is a measure of how many times the total value of the portfolio in the fund gets traded during the year. A Turnover Ratio of 150% means that the total value of the fund will "turn over" 1.5 times during the year. The higher the turnover ratio, the more trading the manager is doing in pursuit of investment returns.

Trading is done by the fund manager in an attempt to buy low,sell high, find bargains, and ultimately to "beat the market" or at least beat the index by which the fund measures itself, like say the S&P 500. The costs of these trades can't realistically be disclosed up front like the Expense Ratio or other fees because you never know how much trading will be done, with which trading partner, and what those costs might add up to. Make no mistake however, trading costs are a drag on your return and some are worse than others.

For an example, let's randomly choose a fund to examine, say the Schwab Large Cap Growth fund at the following link: http://finance.yahoo.com/q/pr?s=SWLSX+Profile

In the "Fees & Expenses" section you'll find that this fund has a Prospectus Gross Expense Ratio of 1.04% (as of this writing). There are no sales load fees or 12b-1 fees associated with this fund, so you might expect that your costs would only be that 1.04% per year, roughly $104.00 per $10,000 invested.

In the "Fund Operations" section, you'll see the "Annual Holdings Turnover" of 82%. So at that level, just 18 points shy of a 100% turnover, there is definitely some serious trading going on. We know they're paying something to make those trades, but what is that costing you in terms of your total return?

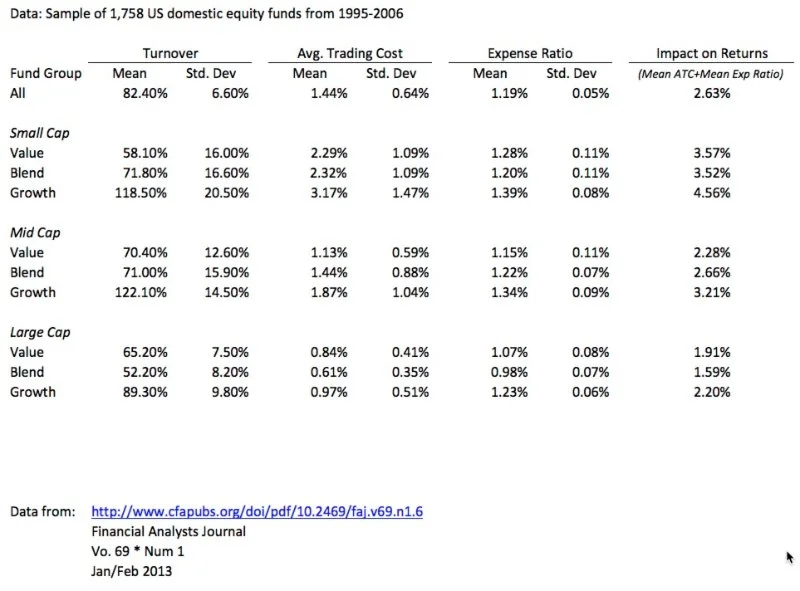

Research from the Financial Analysts Journal (link below) published in 2013 indicates that trading costs can reach levels equal to or even greater than the stated expense ratio. You are of course welcome to read the research yourself but a summary table can illustrate the point:

Link to original research: http://www.cfapubs.org/doi/pdf/10.2469/faj.v69.n1.6

Continuing with our example of SWLSX and consulting the table above, a Large Cap Growth fund from the study has a Turnover Ratio of 89.3%, which is fairly close to the 82% of SWLSX. That same category has an Average Trading Cost of 0.97%, which is in addition to the stated Expense Ratio of 1.04%, for a total potential expense of +/- 2.01%, which is not quite double what you thought you were paying in expenses.

So, generally speaking, the higher the turnover rate in a fund, the higher the trading costs will be. In specific categories those costs can be little more or a little less but it's an easy to understand idea and the costs to the investor are real. It may not sound like much for any one year but remember we're talking about investment horizons that can be 30+ years out, so those costs compounded over time can cut very deeply. The larger your portfolio, the larger these costs will be and the greater your compounded returns will suffer.

None of this is meant to dissuade you from using an active management strategy but to give you more information to inform your decision. This data doesn't cover all categories and of course the last of the data set was from 2006. Things have changed since then, expenses have come down, markets have changed, etc. Just know that trading incurs costs and those costs come out of your investment returns, either explicitly or implicitly. As I was reminded by an old cartoon from my childhood: Knowing is half the battle. That sentiment is particularly true of investing. Know what you're getting into before you get into it, so you can more accurately gauge your expectations.

How do you avoid these costs and keep more of that money for yourself? Different people and advisors will have a different opinions of course, so your mileage may vary. For myself, I recommend an index fund approach, which keeps both the expense ratio and turnover to a minimum. I do give up the chance that my index fund will ever beat the market but I always know I won't really be much below the market either; such is the nature of index funds. That however is a subject for a different day.